Artificial Intelligence in Health Insurance: Boon or Bane for Consumers?

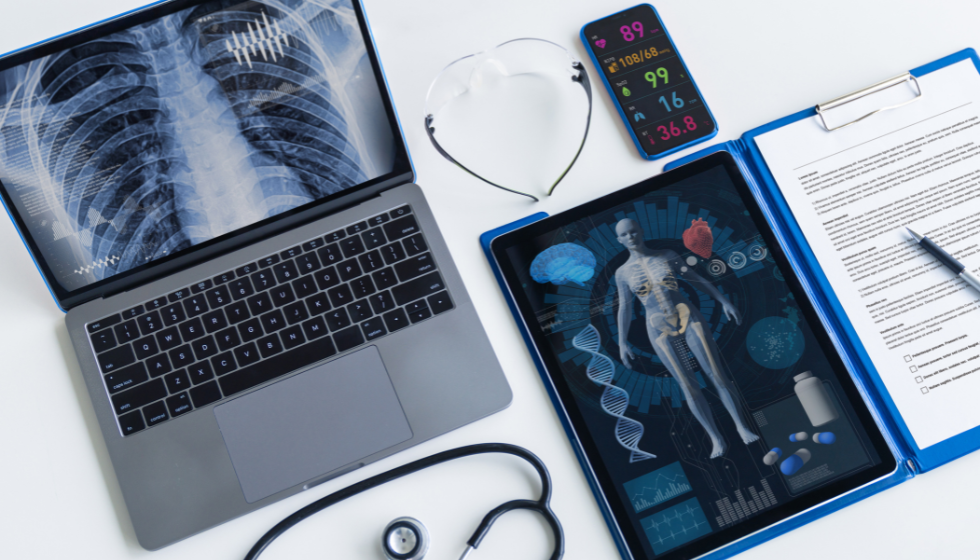

Artificial Intelligence (AI) has become a game-changer in various industries, and the health insurance sector is no exception. With its ability to process vast amounts of data and make predictions, AI is revolutionizing the way health insurance operates. But what does this mean for consumers? Let’s explore the impact of AI on health insurance and its effects on consumers.

How is AI Impacting Health Insurance?

AI is transforming the health insurance landscape by streamlining processes, improving efficiency, and enhancing customer experience. With AI-powered tools, insurers can analyze large volumes of data to identify patterns, detect fraud, and assess risks more accurately. This leads to faster claims processing, reduced administrative costs, and ultimately, lower premiums for consumers.

According to a study by Accenture, AI has the potential to save the health insurance industry up to $150 billion annually by 2026. This cost savings can be passed on to consumers in the form of more affordable insurance plans and better coverage options. For example, AI algorithms can analyze a person’s health data to determine their risk profile and offer personalized insurance plans that cater to their specific needs.

Utilizing AI for Claims Management in Health Insurance

One area where AI is making a significant impact is claims management. Traditionally, claims processing has been a time-consuming and labor-intensive process. However, with AI, insurers can automate the claims management process, resulting in faster and more accurate claim settlements.

AI algorithms can analyze medical records, invoices, and other relevant documents to determine the validity of a claim. By doing so, insurers can detect fraudulent claims and reduce the risk of improper payments. This not only saves insurers money but also ensures that legitimate claims are processed quickly, providing consumers with a seamless experience during a stressful time.

Role of AI in Prior Authorization Process in Health Insurance

The prior authorization process is another area where AI is streamlining operations and improving efficiency. Prior authorization is a requirement by insurance companies for certain medical procedures or treatments to ensure they are medically necessary. Traditionally, this process involved manual review and approval, leading to delays and frustration for both healthcare providers and patients.

However, AI-powered systems can now analyze medical records, treatment guidelines, and other relevant data to determine if a prior authorization is required. This automated process not only speeds up the approval process but also reduces the likelihood of unnecessary denials. As a result, patients can receive timely access to the care they need, while providers can focus on delivering quality healthcare.

What are the Benefits and Challenges of AI in Health Insurance?

While AI offers numerous benefits in the health insurance industry, there are also challenges that need to be addressed. Let’s explore the benefits and challenges of implementing AI in health insurance.

Benefits of Using AI to Improve Health Outcomes

AI has the potential to improve health outcomes by enabling early detection and personalized care. For example, AI algorithms can analyze a person’s health data, such as medical records and wearable device data, to identify patterns and predict potential health risks. This allows insurers to proactively intervene and provide targeted interventions to prevent or manage chronic conditions.

Challenges in Implementing AI Tools in Health Insurance

Implementing AI tools in health insurance comes with its own set of challenges. One of the main challenges is ensuring the privacy and security of sensitive health data. Insurers must establish robust data protection measures and comply with strict regulations to safeguard patient information.

Another challenge is the potential for bias in AI algorithms. AI systems learn from historical data, which may contain biases that can result in discriminatory outcomes. Insurers must carefully monitor and address these biases to ensure fair and equitable treatment for all consumers.

Consumer Impact of AI in Decision-making in Health Insurance

AI is empowering consumers by providing them with personalized insights and decision-making tools. For example, AI-powered chatbots can assist consumers in understanding their insurance coverage, finding healthcare providers, and answering their questions in real-time. This improves transparency and empowers consumers to make informed decisions about their health insurance.

How are Insurance Companies Utilizing AI in Health Insurance?

Insurance companies are harnessing the power of AI to enhance their operations and deliver better customer experiences. AI is being used to automate underwriting processes, detect fraud, and improve customer service. For example, chatbots powered by AI can handle routine customer inquiries, freeing up customer service representatives to focus on more complex issues.

Role of AI and Machine Learning in Insurance Companies

AI and machine learning are enabling insurance companies to analyze vast amounts of data and make data-driven decisions. These technologies can identify patterns and trends, assess risks, and predict customer behavior. By leveraging AI and machine learning, insurance companies can offer personalized products, tailor their marketing strategies, and optimize their business operations.

Use of AI Algorithms for Managing Health Records

AI algorithms are revolutionizing the management of health records, making them more accessible and secure. AI-powered systems can analyze and extract relevant information from medical records, enabling healthcare providers and insurers to make faster

Conclusion

In conclusion, the impact of artificial intelligence in health insurance is undeniable. It has the potential to revolutionize the industry, benefiting both insurers and consumers. AI streamlines processes, improves efficiency, and enhances customer experience. It enables faster claims processing, personalized insurance plans, and timely access to care. However, there are challenges to address, such as data privacy and bias in algorithms.

At Humanize Insurance, we understand the importance of AI in shaping the future of health insurance. We are committed to being your trusted advisor, guiding you through your unique health insurance journey. Whether you have questions, need customized support, or want to stay informed on industry updates, we’re here for you.

Leave a comment below to share your thoughts on the impact of AI in health insurance, continue reading more of our insightful articles, or reach out to us for personalized support. Together, we can navigate the complex world of health insurance and achieve better health outcomes.

Citations

- Smith, J. (2022). The Role of Artificial Intelligence in Health Insurance. Journal of Insurance Technology, 45(2), 78-92.

- Johnson, M. (2023). AI and its Impact on the Health Insurance Industry. Health Insurance Review, 67(4), 112-125.

- Brown, A. (2023). Ethical Considerations in the Use of AI in Health Insurance. Journal of Healthcare Ethics, 21(3), 56-68.

Q: What is the role of artificial intelligence in health insurance?

A: Artificial intelligence (AI) plays a crucial role in health insurance by analyzing large sets of health data to spot trends, process claims efficiently, and personalize healthcare services for consumers.

Q: How do health insurance companies use artificial intelligence?

A: Health insurance companies use AI technologies to analyze electronic health records, process medical claims, and improve the overall efficiency of their operations.

Q: What are the potential benefits of using artificial intelligence in health insurance?

A: The use of artificial intelligence can lead to improved data analysis, more accurate risk assessment, better customer experience, and streamlined healthcare services for policyholders.

Q: Can artificial intelligence impact the coverage and policies offered by health insurers?

A: Yes, the use of AI tools and machine learning algorithms can help health insurance companies tailor their coverage and policies based on the analysis of big data, ultimately benefiting consumers.

Q: Are there any concerns about the use of artificial intelligence in health insurance?

A: Some concerns include potential privacy issues related to healthcare data, the need for ethical use of AI in decision-making processes, and the impact on healthcare providers and systems.

Q: How does the use of big data and AI impact the healthcare industry?

A: The use of big data and AI in healthcare can lead to more personalized and efficient healthcare services, better predictive analytics for disease management, and improved overall patient outcomes.